flow-through entity tax form

Michigan Enacts Flow-Through Entity Tax as Workaround to State and Local Cap. The income and losses are already classed and apportioned for Pennsylvania purposes as reported on the Schedule RK-1 and NRK-1 received from the pass.

:max_bytes(150000):strip_icc()/ScreenShot2022-01-24at10.05.23AM-cf89715f09964cbca096821b63196735.png)

Form 1099 K Payment Card And Third Party Transactions

Branches for United States Tax Withholding and Reporting.

. This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain and loss resulting from the disposition of shares of or interests in a flow-through entity. If you filed Form T664 Election to report a Capital Gain on Property owned at the End of February 22 1994 for any of the above shares. Apportionment Calculation and Business Income Identification.

Schedule 5774 Part 1. Form W-8 IMY may serve to establish foreign status for purposes of sections 1441 1442 and 1446. The information in this section also applies if for the 1994 tax year you filed Form T664 Election.

For calendar filers that date is March 31. Click Next to continue. As signed into law by Governor Whitmer on December 20 2021 PA 135 of 2021 amends the Income Tax Act to create a flow-through entity tax in Michigan.

Michigan Treasury Online MTO Screenshots. Represent that a foreign person is a qualified intermediary or. Income From Pass Through Entities.

February 03 2022 State Local Tax. Information about Form W-8 IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. A trust established to hold shares of the capital stock of a corporation in order to exercise the voting rights attached to such shares.

Branches for United States Tax Withholding and related Instructions is used by foreign intermediaries and foreign flow-through entities as well as certain US. Quarterly estimated entity flow-through tax payments will be required in 2022 if entity level. 5376 on December 20 2021 enacting a flow-through entity tax for those doing business in Michigan.

October 2021 Department of the Treasury Internal Revenue Service. Pass Through entities must provide to its entity owners a Schedule RK-1 and NRK-1 detailing the entity owners share of pass through income and losses during the taxable year. LOG IN TO PAY Entities must use our online Web File application and pay by ACH debit when making PTET payments.

Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US. Generally the flow-through entity tax allows certain flow-through entities to elect to file a return and pay tax on income in Michigan and allows members or owners of that entity to. Form W-8IMY Certificate of Foreign Intermediary Foreign Flow-Through Entity or Certain US.

This legislation was passed as a workaround to the federal 10000 state and local tax deduction limitation that has. In tax years beginning in 2021 flow-through entities with items of international tax relevance must complete the new schedules as described in the instructions and the updates posted on January 18 2022. A trust established for the benefit of creditors in order to secure certain debt obligations.

Non-Electing Flow-Through Entity Income Schedule. Flow-Through Entity FTE Tax Return Form 5772. For cash basis taxpayers entity level tax payments must have been made by December 31 2021 to deduct such taxes on their individual federal tax return 1040 in 2021 payments made after that date will be deductible on the 2022 individual federal tax return.

Enter the business account number and select Flow-Through Entity tax. Choose PTET web file from the Corporation tax or Partnership tax expanded menu then select Pass-through entity tax PTET estimated payment. The flow-through entity tax annual return is required to be filed by the last day of the third month after the end of the taxpayers tax year.

It replaces line 16 portions of line 20 and numerous unformatted statements attached to prior versions of the Schedule K-1 Form 1065 Schedule K-1. An annual return must be filed by an electing flow-through entity each year the entity is subject to the tax even if the liability is zero. Governor Whitmer signed HB.

Section references are to the Internal Revenue Code. Branches for United States Tax Withholding and Reporting including recent updates related forms and instructions on how to file. Form 5773 Non-electing Flow-Through Entity Income Template Form 5774 Part 1 Corporations Insurance Companies and Financial Institutions Template Form 5774 Part 2 Individuals Fiduciaries and Other Flow-Through Entities Template.

Enter the Tax Year for the tax return you need to file. Click Next to continue.

W 9 Form Download Tax Forms Blank Form Irs Forms

/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits

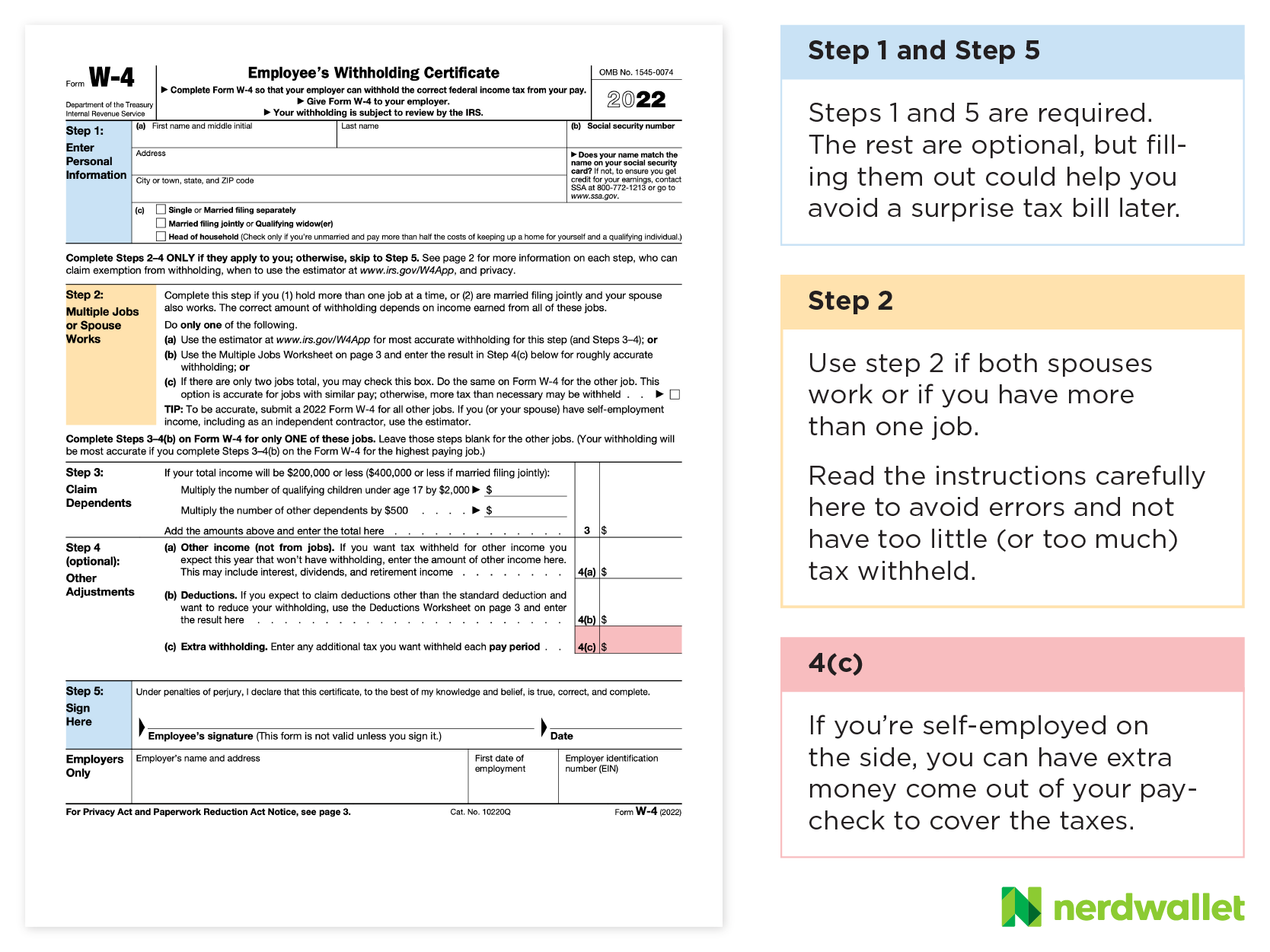

W 4 Form What It Is How To Fill It Out Nerdwallet

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at8.30.22AM-d7e4bd231b2148cea273c25d3656e946.png)

Schedule K 1 Beneficiary S Income Deductions Credits

What Is An Llc Business Structure Accounting Training Limited Liability Company

Understanding Your Own Tax Return Tax Forms Payroll Taxes Federal Income Tax

Income Taxes The Ides Of March S Corporation Finance

Cash Flow Statement Printable Pdf Letter A4 A5 Etsy Cash Flow Statement Small Business Bookkeeping Small Business Printables

Tax Flowchart Do You Have To File A Return Flow Chart Flow Chart Template Law School Humor

Section 199a Tax Deduction Tax Deductions Financial Planner Deduction

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

What Is Irs Free File Gusto Filing Taxes Income Tax Return Irs

Form 12 12a Five Ways On How To Prepare For Form 12 12a Federal Income Tax Tax Forms Irs Taxes

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench With Regard To Irs W9 Form 2021 Getting Things Done Personal Calendar Irs

Fillable Form 1040 Schedule C 2019 Irs Tax Forms Tax Forms Credit Card Statement

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)