michigan sales tax exemption for manufacturing

The good news is that the Sales Tax Educators already completed the research and identified Michigans manufacturing sales tax exemptions. All fields must be.

Michigan Tax Considerations For Alternative Energy Producers Varnum Llp

While the Michigan sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation.

. Document Processing P288. While most services are exempt from tax there are a. Employees sales tax knowledge usually range from.

However if provided to the purchaser in electronic. On June 8 the Michigan legislature in an overwhelming bipartisan vote passed two bills providing for exemptions from the states sales and use tax. This page describes the taxability of.

Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into. Michigan allows businesses to claim an exemption on the portion of their utility used in industrial processing which includes but is not limited to production or assembly research. Use tax is a companion tax to sales tax.

In order to claim exemption the nonprofit organization must provide the seller with both. The Sales Tax System set for Michigan uses five tax-training books to educate and train employees on how to review the manufacturing sales tax processes. Thursday June 10 2021.

State sales tax research already completed. Managing the sales tax process it is crucial to review identify and understand the states manufacturing sales tax exemptions. Purchasing the Exempt and Taxable reference book has the following benefits such as.

Sales Tax Return for Special Events. While Michigans sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. The Michigan sales and use tax exemptions for both the agricultural industry and the industrial processing or manufacturing industry include such language.

In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Michigan Sales and Use Tax Certificate of Exemption. 04 Manufacturing 13 Non-Profit Hospital 05 Government.

Our training system set. Streamlined Sales and Use Tax Project. Liable for sales or use tax on the purchase of the dies delivered to.

Michigan Department of Treasury Tax Compliance Bureau Updated March 2019 Page 8 of 98. For transactions occurring on and after October 1 2015 an out-of-state seller may be. It is the Purchasers.

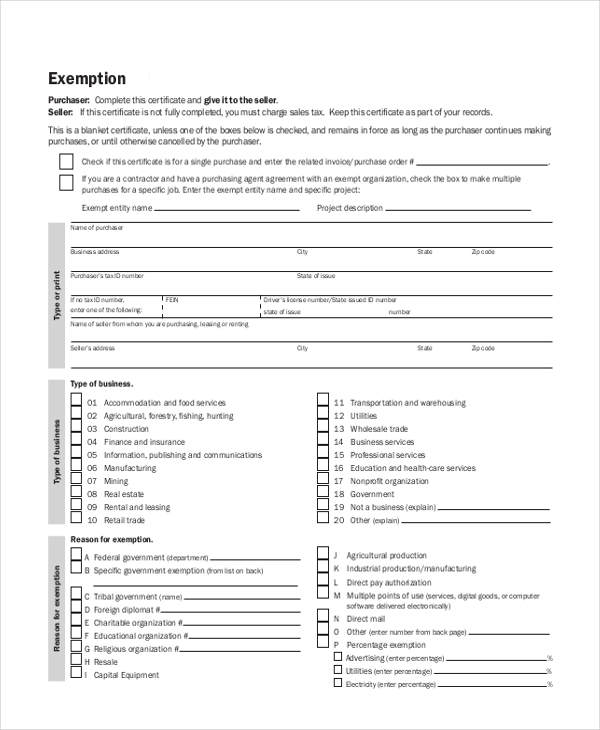

This page discusses various sales tax exemptions in Michigan. Ohio Revenue Code Ann. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

A completed Form 3372 Michigan Sales and Use Tax Certificate of Exemption. Notice of New Sales Tax Requirements for Out-of-State Sellers. Purchase the Sales Tax Exemptions book.

Focus is on manufacturing operations and not retail. Michigan Sales and Use Tax Contractor Eligibility Statement. Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions.

The Ohio sales tax exemption for manufacturing is broad and encompasses a wide array of purchases used in the manufacturing process.

Big States Eye Tax Breaks On Face Masks And Hand Sanitizers

Contractors Working With Qualified Native American Tribes May Be Exempt From Sales Use Tax Beene Garter A Doeren Mayhew Firm

Sales And Use Tax Regulations Article 3

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Michigan Sales Tax Exemption For Manufacturing Agile Consulting

Free 10 Sample Tax Exemption Forms In Pdf Ms Word

Understanding Consumable Supplies Sales Tax Exemptions For Manufacturers

Manufacturing Sales Use Tax Software Thomson Reuters Onesource

Perrigo Expands Commitment In West Michigan With New Construction Jobs

Michigan Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax Update For Nonprofits

Michigan Won 5 Big Electric Vehicle Projects This Year At A 2b Taxpayer Cost Mlive Com

Michigan State Tax Updates Withum

Michigan Utility Sales Tax Exemption Utility Study Experts

Kansas Manufacturing Sales Tax Exemptions Smartsave

Michigan S Ppt Exemptions Can Help You Save But Do You Qualify

Michigan Updates Construction Sales Tax Guidance Grant Thornton

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com